Do NOT click away !

Brexit has changed the requirements for deliveries to the UK. As of 01.01.2021, new requirements apply. These have implications both, for us as a dealer and for you as a customer. In the following we have summarized what is changing and what these changes mean in detail.

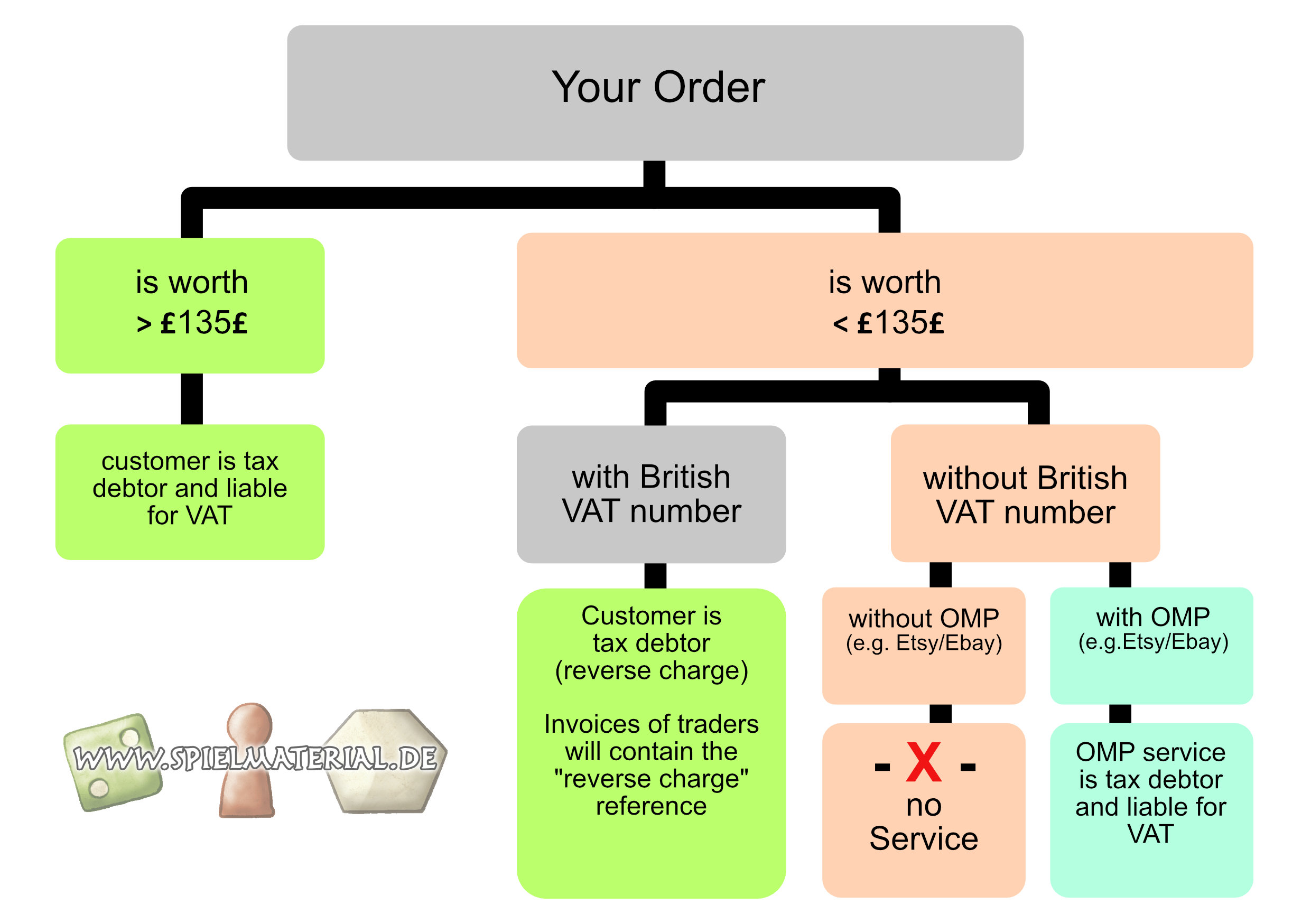

The following cases must be distinguished:

- Value of goods (without shipping costs)

- > £135 (~ 140 EUR)

For shipments of goods exceeding the value of £135, the UK customer is liable for import VAT and, if applicable, customs duties. Also, dhl is charging a fee of £12. All t hese fees must be paid by the customer before the goods can be received. A B2B client will have to provide the EU VAT number. We will issue an invoice WITHOUT VAT. - < £135 (~ 140 EUR)

For goods shipments that do not exceed a value of £135, there is generally no UK import VAT. However, there is a difference between B2B and B2C orders:

- B2B:

If the customer provides the trader with a UK VAT number, the customer becomes the tax debtor under a reverse charge procedure. In this case, the invoice of the trader will contain the reference "reverse charge". - B2C:

Since we as a trader would have to pay the import VAT and would also have to fulfill various bureaucratic tasks, we refrain from making deliveries with a goods value of below £135 to the UK. Then again, there are different regulations for online marketplaces (OMP): With OMP participation, the OMP is considered the supplier from a VAT point of view and therefore the tax debtor. So if you want to buy our below the value of £135 we need to work with etsy. Please place in addition an order there, buying this item https://www.etsy.com/de/listing/1784747585/spielmaterial-game-components-dummy.

------------------------------------------------------

The following graphic shows the different cases: